FOREIGN DUTY AND LAND TAX SURCHARGES

Victoria was the first State in Australia to introduce foreign duty and land tax (absentee owner) surcharges on the acquisition of residential lands by foreign purchasers. Subsequently, all State and Territory governments have passed similar legislation to introduce foreign surcharge provisions in each of their own jurisdictions, with slight (but important) differences between them.

Legislation in this area is complicated, often being amended, and cannot be fully summarised in a few paragraphs. The information contained on this site is only an introduction to foreign purchase surcharges and does not cover each individual situation.

As a general statement, duty (including foreign duty surcharges) applies to direct and indirect acquisitions of property. Indirect acquisitions of property can include acquiring interests in land holding entities (including trusts, partnerships, and companies).

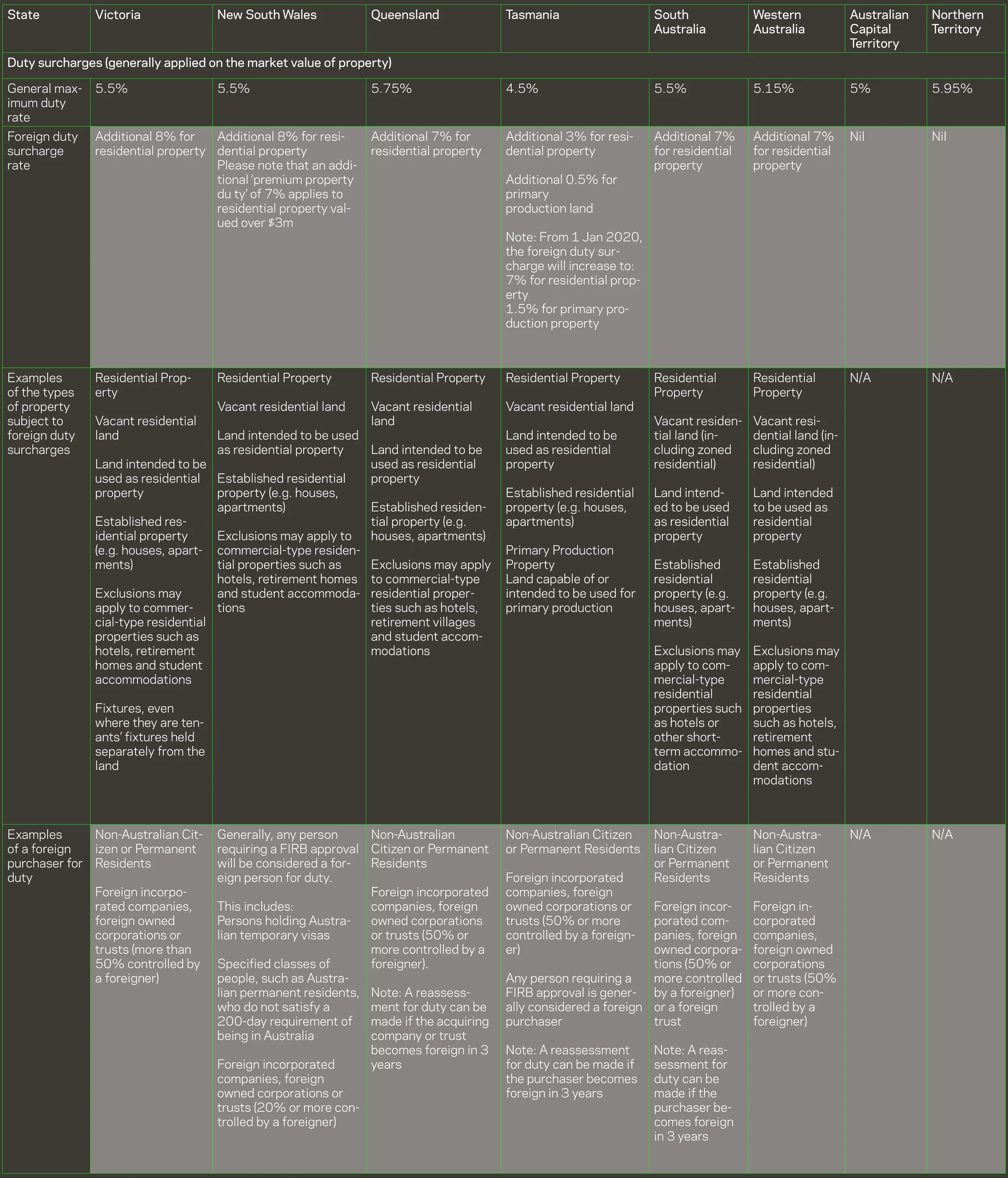

The following tables briefly summarise the different foreign surcharges and the types of underlying property interests captured in each State and Territories as at the commencement of the 2019 financial year.

DETERMINING A FOREIGN PURCHASER

Acquisitions of real property can be undertaken by a land or property holding entity with nuanced layers of underlying ownership. This adds further complexity to the provisions, which are not dealt with here. Briefly, the varying provisions across the States and Territories provide for an ability to ‘look through’ the ownership structure of a land holder to ascertain if the entity is a foreign purchaser.

For land tax purposes, the Victorian absentee owner definition is broader than the equivalent ‘foreign purchaser’ definition for duty purposes.

What does this mean for purchasers?

The foreign or absentee surcharge regimes in the States and Territories increases the complexity and onus on all taxpayers to comply with the myriad of taxation requirements in Australia. Due to the subtleties of each piece of legislation, some taxpayers may already have exposure to surcharge liabilities without their (or their advisors’) knowledge. Given the various revenue authorities’ growing access to data, together with technology and data matching capabilities, it follows that investigations on known and unknown tax breaches are likely to increase over time.

A common example of a problematic scenario is a family discretionary trust, in which the family involved has a foreign relative. Typically, discretionary trust deeds are purposefully broadly drafted to include a broad class of general beneficiaries (including extended family members) with corresponding powers of the trustee to distribute capital to any beneficiary. Such broadly drafted discretionary trust deeds are likely to have unintentionally brought in the foreign relatives as beneficiaries of the trust, which may “taint” the family trust as a foreign or absentee trust in some jurisdictions.

Proper care be taken to review:

Each taxpayer’s land or property holding vehicle (particularly trusts and corporate entities with any potential underlying foreign ownership).

If any taxpayer is unnecessarily paying the surcharge due to the land or property potentially falling out of the ‘residential property’ classifications.

If any taxpayer may be entitled to any applicable treasurer’s discretionary relief, specific exclusions or refunds.

How Harwood Andrews can assist

The legislative provisions in each State and Territory around foreign or absentee surcharges are increasingly complex and can be confusing for clients, tax advisors and accountants to navigate.

Our specialist Commercial team can assist in reviewing each taxpayer’s individual circumstances to ensure that foreign or absentee surcharges aren’t unwittingly triggered. Following a review, we can provide specific advice, in accordance with each individual circumstances, of the possible applications and avenues that may be available.

Trustees who wish to avoid the unintended application of such regimes can also order a Harwood Andrews discretionary trust on our Harwood Andrews online services page. Harwood Andrews’ discretionary trust deeds are formulated so that trustees can order specific discretionary trust deeds with non-foreign trust elections for specific States and Territories.