The Allocation of Profits by Professional Firms: Further Hurdles to be Overcome for IPPs

The Australian Taxation Office (ATO) has released guidelines which set out the ATO’s proposed compliance approach to the allocation of profits by professional firms. The Draft Practical Compliance Guideline PCG 2021/D2 Allocation of professional firm profits – ATO compliance approach (Draft PCG) make substantial changes to the former guidance that the ATO suspended in late 2017.

Essentially, the Draft PCG places previously satisfactory arrangements into the category of moderate or high-risk but fails to explain the reasons or necessity for this shift.

Background

The former guidelines released by the ATO in 2015 titled “Assessing the risk: allocation of profits within professional firms” (Guidelines) provided three benchmark tests (“Benchmarks”) to ensure that ‘individual professional practitioners’ (IPPs) were regarded as being of “low risk” of compliance activity. To be ”low risk” the IPP was required to pass one of the three Benchmarks, namely:

Benchmark 1: ‘appropriate remuneration’: the IPP needed to receive renumeration benchmarked with reference to the lowest paid member of the upper quartile of the firm s/he works for;

Benchmark 2: ‘50% entitlement’: 50% or more of the income from the firm to which the IPP and their associated entities are collectively entitled (whether directly or indirectly through interposed entities) in the relevant year is assessable in the hands of the IPP;

Benchmark 3: ‘30% effective tax rate’: the effective tax rate must be 30% or higher on both income from the firm to which the IPP is entitled and revenue from the firm to which the IPP and their associated entities are collectively entitled.

The ATO suspended these Guidelines on 14 Decmeber 2017 on the basis that some taxpayers and/or advisors were misinterpreting and applying the Guidelines beyond their scope. Since the time, the ATP has said (annually) that any IPPs who entered arrangements prior to 14 Decmeber 2017 could continue to rely on the suspended Guidelines.

Where IPPs entered arrangement after 14 Decmeber 2017, the ATO recommended engaging with it directly.

Approach of the Draft PCG

While the Draft PCG has similarities with the Guidelines, there are a number of considerable differences. The similarities are the three similarly formulated Benchmarks, namely;

Benchmark 1: the proportion of profit returned personally in the hands of the IPP to the total amount of income to which the IPP and his or her associated entities are collectively entitled;

Benchmark 2: the total effective tax rate paid by the IPP and their associated entities; and

Benchmark 3: the IPP should receive assessable income from the firm in its own hands which reflects an appropriate return for the services provided to the firm.

Notwithstanding, there are two key differences between the Draft PCG and the Guidelines:

1. firstly, to apply the Benchmarks, two “Gateways” must first be passed:

a) Gateway 1: the ATO expects there to be sound commercial rationale for entering into or using the arrangement or structure; and

b) Gateway 2: there must not be “high-risk” features.

2. Secondly, where an IPP’s circumstances pass the two “Gateways”, the IPP can then apply the three Benchmarks to receive a “traffic light” risk assessment of green (low risk), amber (moderate risk) or red (high risk). If the IPP does not satisfy the three Gateways, the risk assessment framework (outlined below) is not made available to the IPP.

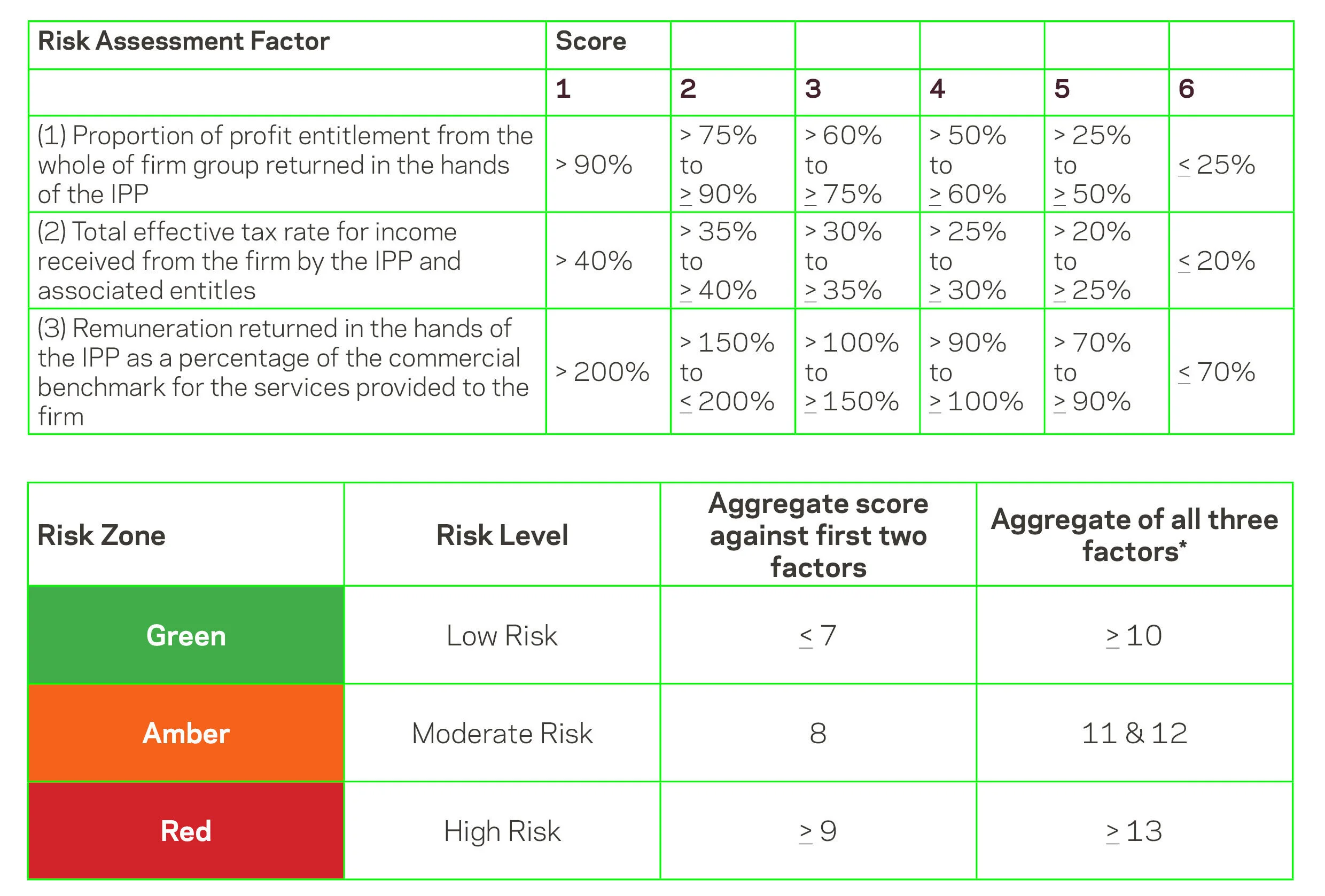

Risk assessment scoring table

Unlike the Guidelines, where the IPP only needed to satisfy one Benchmark, the Draft PCG requires an IPP that passes the two Gateways to apply both Benchmarks 1 and 2 (with Benchmark 3 being optional) to determine a risk rate.

An IPP with an effective tax rate of 30% returning 50% in their own pockets would have satisfied two of the Benchmarks in the Guidelines (the IPP only needed to satisfy one). Under the Draft PCG, assuming the IPP satisfies the two Gateways, the IPP will receive a ‘score of 9’ classifying the IPP as “high-risk”.

The Draft PCG states “[i]f your arrangement does not have a low (that is, green zone) risk rating, we consider your arrangement, or your treatment of that arrangement, is at risk of giving rise to an inappropriate tax outcome. Therefore, we will generally conduct some form of compliance activity to further test the tax outcomes of your arrangement.”

Hence, the Draft PCG expects IPPs to annually assess eligibility and document the assessment of that eligibility.

What hurdles are introduced by the Draft PCG?

When applying Benchmarks outlined in the Draft PCG, many of the previously acceptable arrangements under the Guidelines shift into the amber or red risk category. As outlined, the Draft PCG does not attempt to justify the reason or necessity for this shift.

It appears unusual for an arrangement that is commercially motivated (and does not present high risk features) and the Gateways satisfied, to then be classified in accordance with the assessment framework as moderate risk or high risk.

Additionally, a key principle established within the Guidelines was that they were structurally agnostic. Essentially, this assisted the ATO to avoid wasting time with questions regarding structures and leading to different outcomes based on structures, not economic consequences. The Draft PCG adopts a different approach by considering multiple classes of shares or units as a high-risk factor under Gateway 2 and subsequently introducing a bias towards certain structures.

By establishing the need to self-assess annually, and pushing most existing acceptable arrangements into the amber zone (moderate risk) or red zone (high risk), there is a substantial compliance burden placed on IPPs.

Conclusion

Submissions on the Draft PCG are due by 26 March 2021.

Once completed, the Draft PCG will apply from 1 July 2021. Importantly, ‘Commercially driven’ arrangements with no high-risk features entered before 14 December 2017 can rely on the Guidelines until 30 June 2021. Transitional arrangements apply for IPPs whose arrangements were low-risk under the suspended Guidelines but are moderate or high risk under the Draft PCG.

If you would like advice in relation to the Draft PCG, please contact:

Rob Warnock

Principal Lawyer

T: 03 5226 8541

E: rwarnock@ha.legal

Alexander Gulli

Lawyer

T: 03 5226 8573

E: agulli@ha.legal